28+ qualify for a mortgage loan

Head on over to our calculator to punch those numbers. Web What you need to qualify for a mortgage Conventional loans.

Great Lakes Bay Listings Real Estate Magazine 10 28 By Midland Daily News Issuu

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

. Homebuyers who put down 20 or more tend to be offered lower interest rates since. Usually lenders do not want borrowers having monthly payments exceeding more than 28 to 44 of the borrowers monthly income. Homeowners insurance annual 1100.

Generally you can buy a home with no down payment with a VA loan. Essentially your mortgage payment including the insurance taxes etc should not exceed more than 28 percent of your pre-tax income and your total debt car payment student loans etc should not exceed 36 percent of your pre-tax income. VA loans are backed by the Department of Veterans Affairs.

Property Taxes annual 2500. Web To qualify for a mortgage loan at a bank you will need to pass a stress test. Divide your loan amount by the.

However there are many types of mortgages that. Web Check all that apply. To raise your score make payments on time work to.

The housing expense ratio which is made up of monthly principal interest property taxes and insurance payments PITI. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. If youre in a position that receives bonus income we may be able to use that extra income to help.

Web VA loans. You need to pass this stress test even if you dont need mortgage loan insurance. Web Some basic requirements for conforming loans include.

American Heritage Lending LLC located in Irvine CA is looking for a Mortgage Loan FunderCloser. Jumbo loans also called nonconforming loans are mortgages that exceed the conforming loan limits. Lenders look at the Loan to Value Ratio LTV when underwriting the loan.

And the debt-to-income ratio DTI. A minimum credit score of 620 Total debt-to-income ratio of 45 or less A down payment of 3 or more Down payment funds coming from a documented asset source Income limits for some Fannie Mae and Freddie Mac loans 3 4. 1 If your score is lower you may be a candidate for an FHA-insured loan instead which only requires a credit score of 580 and in some cases lower depending on other factors.

Web If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment. Web Loan prequalification calculator terminology In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification. Web How to Qualify for a Mortgage.

Most lenders prefer you. Join to apply for the Mortgage Loan. Of course the exact value will vary depending on the loan term interest rate and lender.

Traditionally lenders like a down payment that is 20 percent of the value of the home. Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Conventional mortgage loans are home loans from private lenders like banks or credit unions that.

Lets say your pre-tax income is 4000. Web Typically lenders cap the mortgage at 28 percent of your monthly income. Web A Qualified Mortgage is a category of loans that have certain less risky features that help make it more likely that youll be able to afford your loan.

Web 3 Likes 0 Comments - Michael Dean Church Mortgage mdcmortgage on Instagram. Web When figuring out what kind of mortgage payment one can afford other factors such as taxes maintenance insurance and other expenses should be factored. Web With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000.

FHA loans are insured by the Federal Housing Administration FHA. Web Please watch the video and contact us at 7026826460 with any questionsWith a mortgage loan professional in your corner youll have a partner by your side. The bank mortgage loan officer says that they must have a Housing Ratio 1 of less than or equal to 28 for the loan to made.

Web Posted 60228 PM. Lenders may offer lower rates to borrowers with higher credit scores. FHA loans have looser credit score and income requirements and can allow you to get a mortgage with as little.

Web The Smiths want to qualify for a mortgage loan with a large local bank. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage.

Established in 2008 the company was founded to be a company set apart from an already impacted market. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your mortgage contract. Web A qualifying ratio is a measurement that mortgage lenders use to help decide if you qualify for the loans they offer.

Web A good rule to follow is the 28 percent36 percent rule. FHA loans are restricted to a maximum loan size depending on the location of the property. Principal and Interest annual 22000.

The qualifying ratio consists of 2 subcomponents. Web How to Get the Best Mortgage Rates. Contact an experience home loan specialist from Veteran United Home Loans at 1-844-488-8229 if you have any questions or want to learn more about VA loan eligibility.

Lenders prefer you spend 28 or less of your gross monthly income on housing expenses. Keep in mind that generally the lower your credit score the higher your interest rate will be which may impact how much house you can afford. Licensed in multiple states across the US the premise.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. Position SummaryThe Mortgage Loan Officer MLO will be responsible for originating the loanSee this and similar jobs on LinkedIn. Save a larger down payment.

Your total monthly payment will fall somewhere slightly above a thousand dollars. A lender must make a good-faith effort to determine that you have the ability to repay your mortgage before you take it out. Improve your credit score.

Web Youll need a FICO score of at least 620 to be eligible for a conventional home loan backed by Fannie Mae. Web What percentage of income do I need for a mortgage. 2800 - 3600 Per Hour.

Jon Vance At Guaranteed Rate Nmls 225599 Vp Of Mortgage Lending Sandy Ut 84070

Apply For An Instant Car Loan Two Wheeler Loan Msme Loan Online At Sk Finance Limited Low Interest Rates Less Documents Easy To Apply

Gary Basin On Twitter Casually Dropping A Litepaper On What I Ve Been Cooking For Four Years It S A Web3 Mortgage Brokerage It S Codenamed Pineapple It S Going To Reinvent Our Housing

Covid 19 Sba Economic Injury Disaster Loan Money Man 4 Business

Basics Of Qualifying For A Mortgage

What Are The Minimum Requirements To Apply For A Mortgage Loan

What Is A Mortgage The Ultimate Guide To Home Loans

Homes Land Of The Tennessee Valley Vol 28 Issue 8 By Homes Land Of Tennessee Issuu

Theresa J Piper Team Captain Go Mortgage Linkedin

Letter Of Explanation For Mortgage Template Inspirational 48 Letters Expl Homeschool Lesson Plans Template Financial Plan Template Homeschool Schedule Template

Mortgage Qualifications How To Qualify For A Mortgage In March 2023

What Are The Minimum Mortgage Qualifications For 2021 Mortgages And Advice U S News

How Much House Can You Afford The 28 36 Rule Will Help You Decide

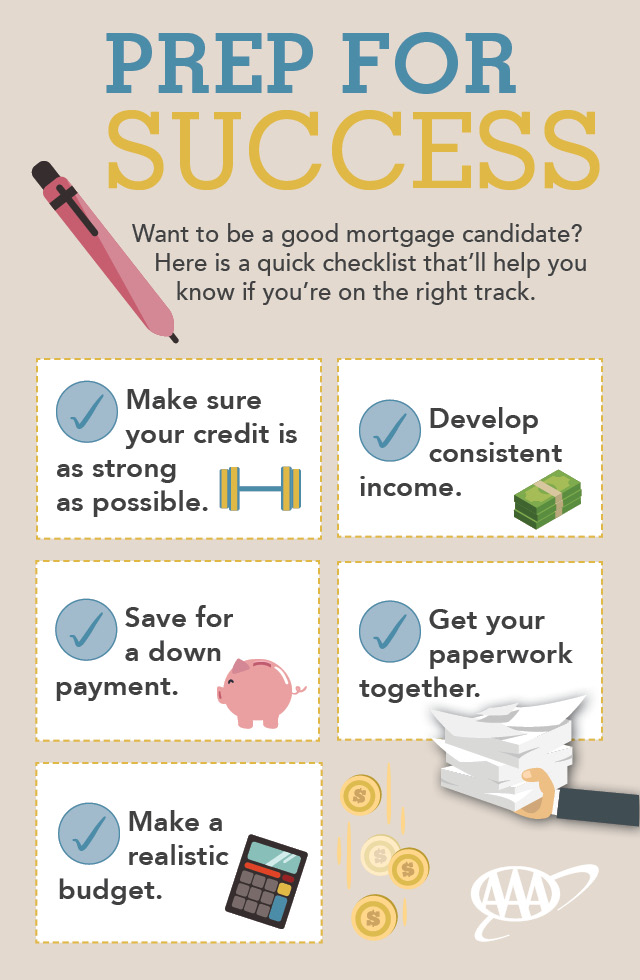

How To Be The Best Mortgage Loan Candidate Your Aaa Network

Loan Officers Custom Mortgage

Home Ml Mortgage Ml Mortgage

David Truong Mortgage Broker In Stanmore Mortgage Choice